Condo Insurance in and around Brea

Brea! Look no further for condo insurance

Protect your condo the smart way

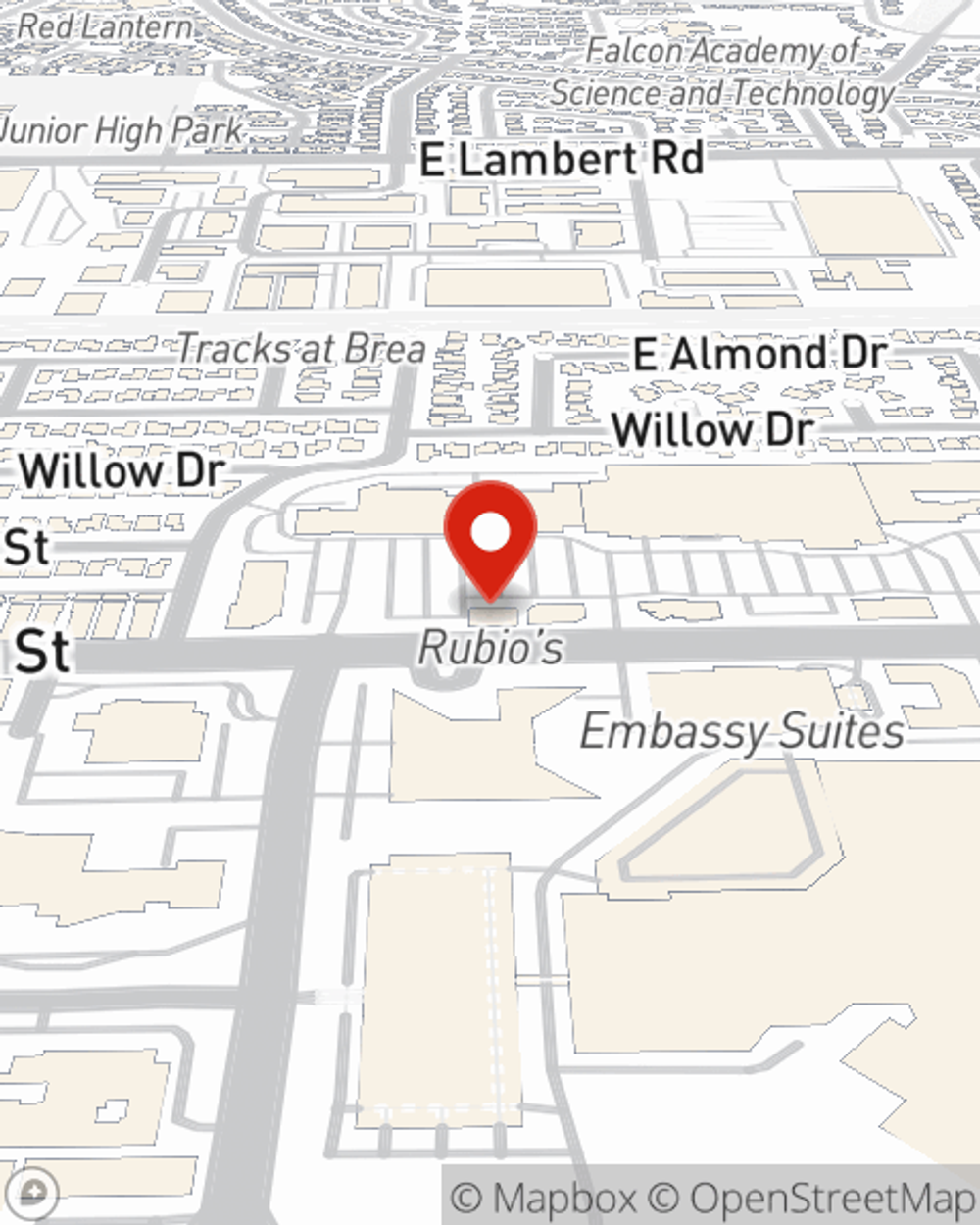

- Brea, CA

- Yorba Linda, CA

- Anaheim, CA

- Fullerton, CA

- Placentia, CA

- La Habra, CA

- Chino, CA

- Walnut, CA

- Scottsdale, AZ

- Phoenix, AZ

- Los Angeles, CA

- Newport Beach, CA

- Mammoth, CA

- Palm Springs, CA

- Dana Point, CA

- Tustin, CA

- Orange, CA

- Irvine, CA

- Laguna Niguel, CA

- Santa Ana, CA

- Brea Mall

- Brea Market Place

Welcome Home, Condo Owners

Because your condo is your retreat, there are some key details to consider - home layout, location, cosmetic fixes, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent coverage options to help meet your needs.

Brea! Look no further for condo insurance

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

Things do happen. Whether damage from weight of snow, fire, or other causes, State Farm has wonderful options to help you protect your condominium and personal property inside against unanticipated circumstances. Agent Diane Viadero would love to help you provide you with coverage that is personalized to your needs.

If you're ready to bundle or find out more about State Farm's wonderful condo insurance, call or email agent Diane Viadero today!

Have More Questions About Condo Unitowners Insurance?

Call Diane at (714) 529-5558 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Diane Viadero

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.